Delivering private investments to the Individual market: a business and legal guide

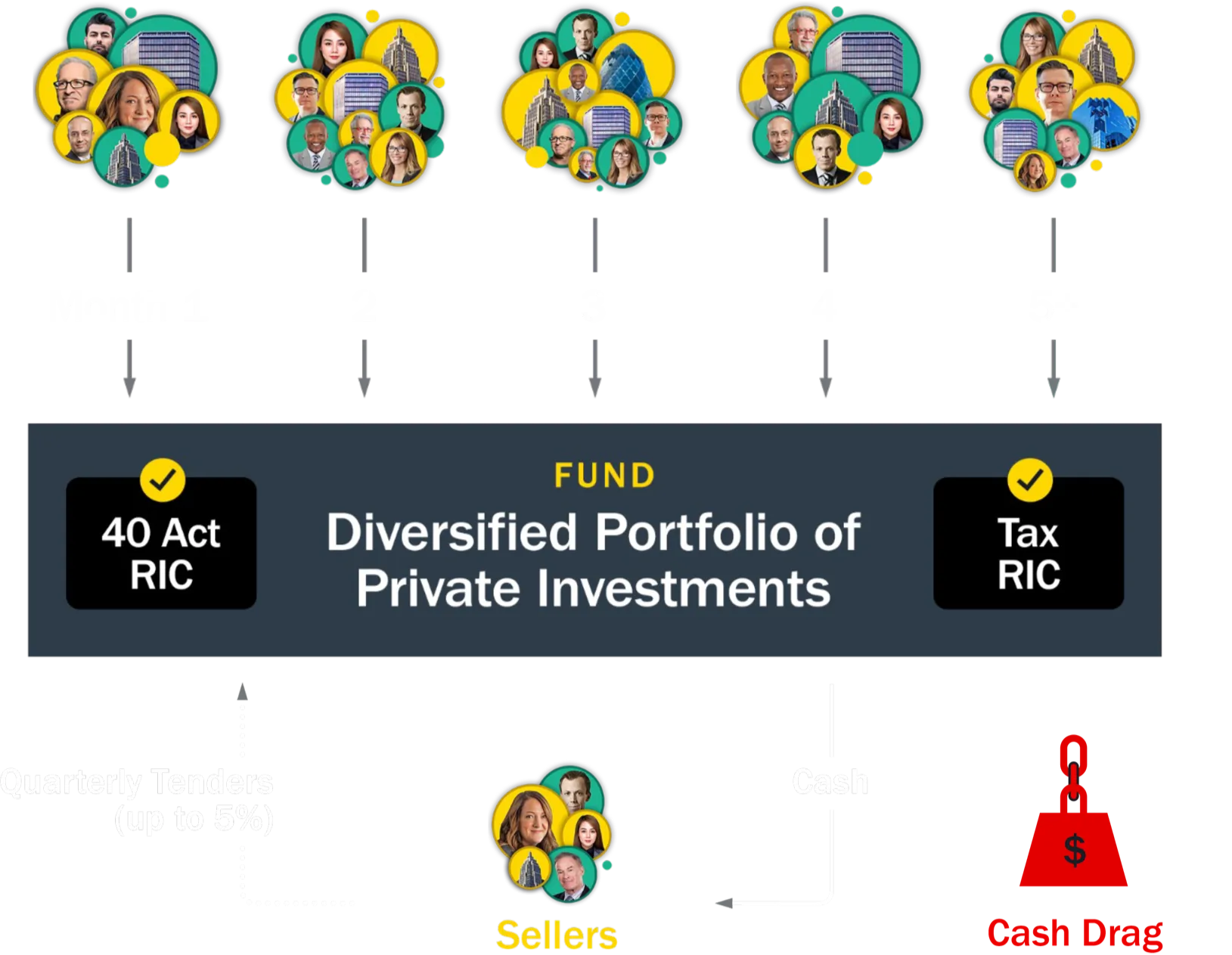

A self-paced virtual course that equips executives and lawyers of private investment funds to address an emerging $10 trillion market, with a focus on the real-world interplay of business strategies, legal structures, and strategic partnering opportunities.

ENROLL NOW

START TODAY

with live office

hours weekly

DURATION

6 MODULES

self-paced virtual course

What You Will Learn

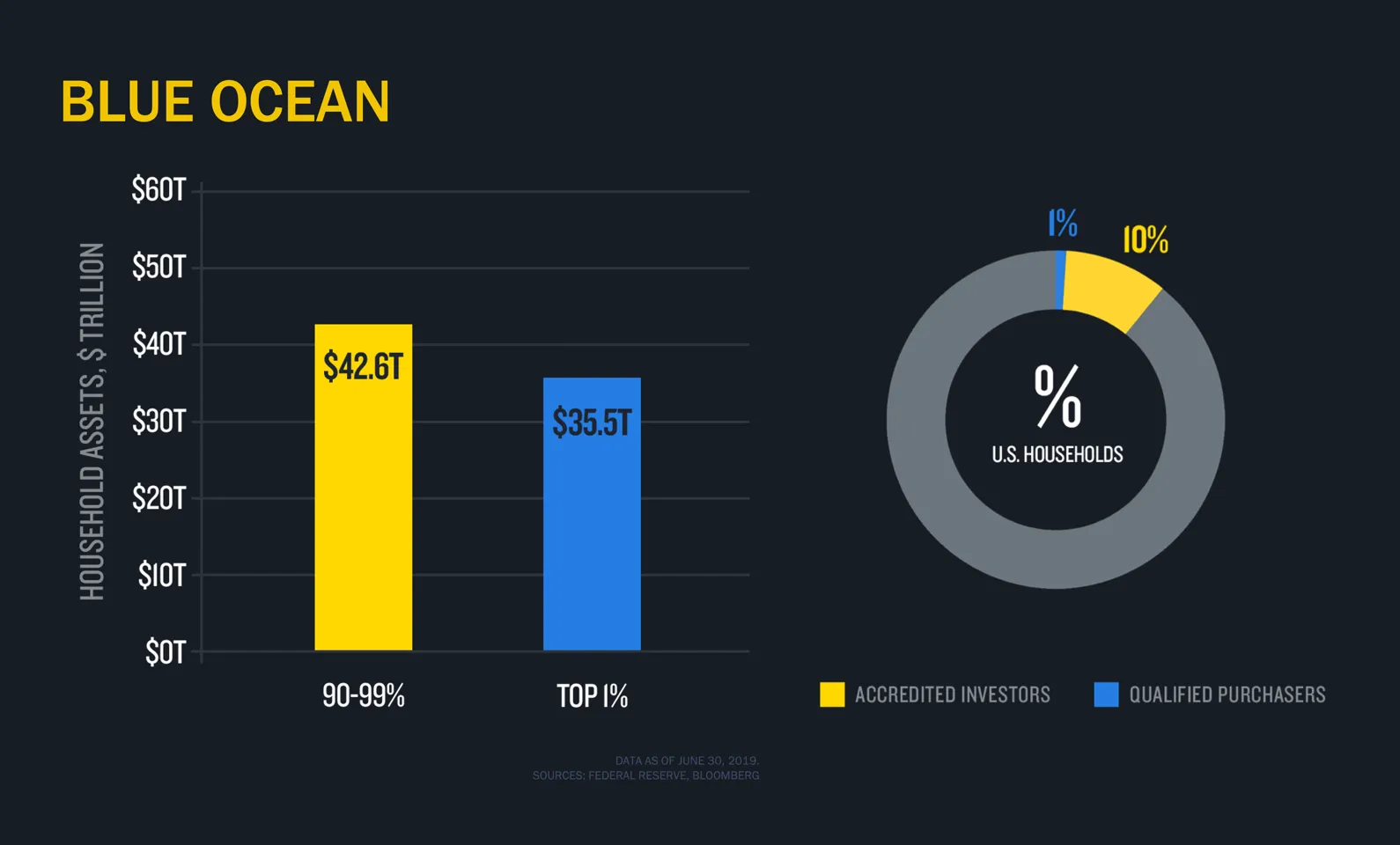

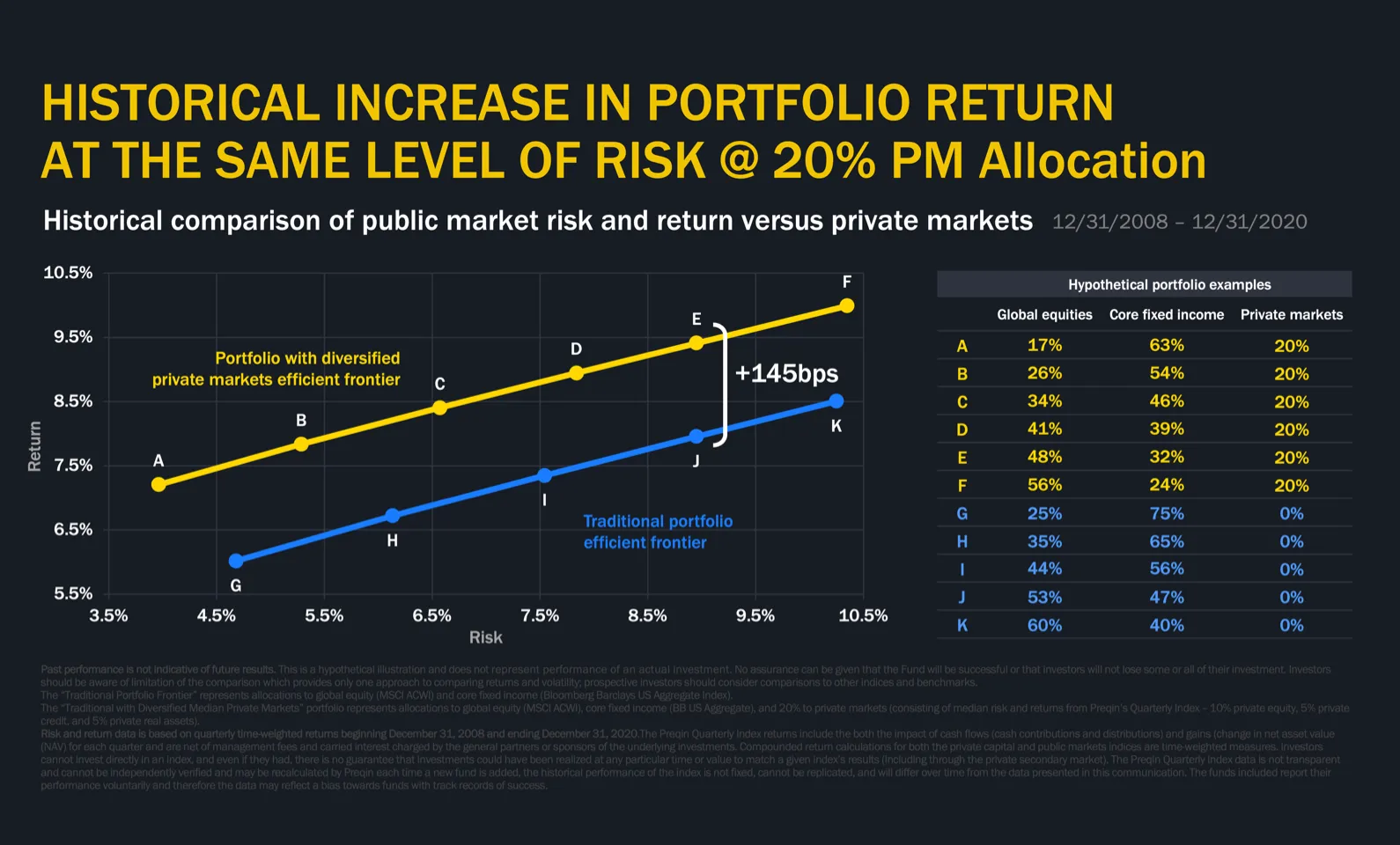

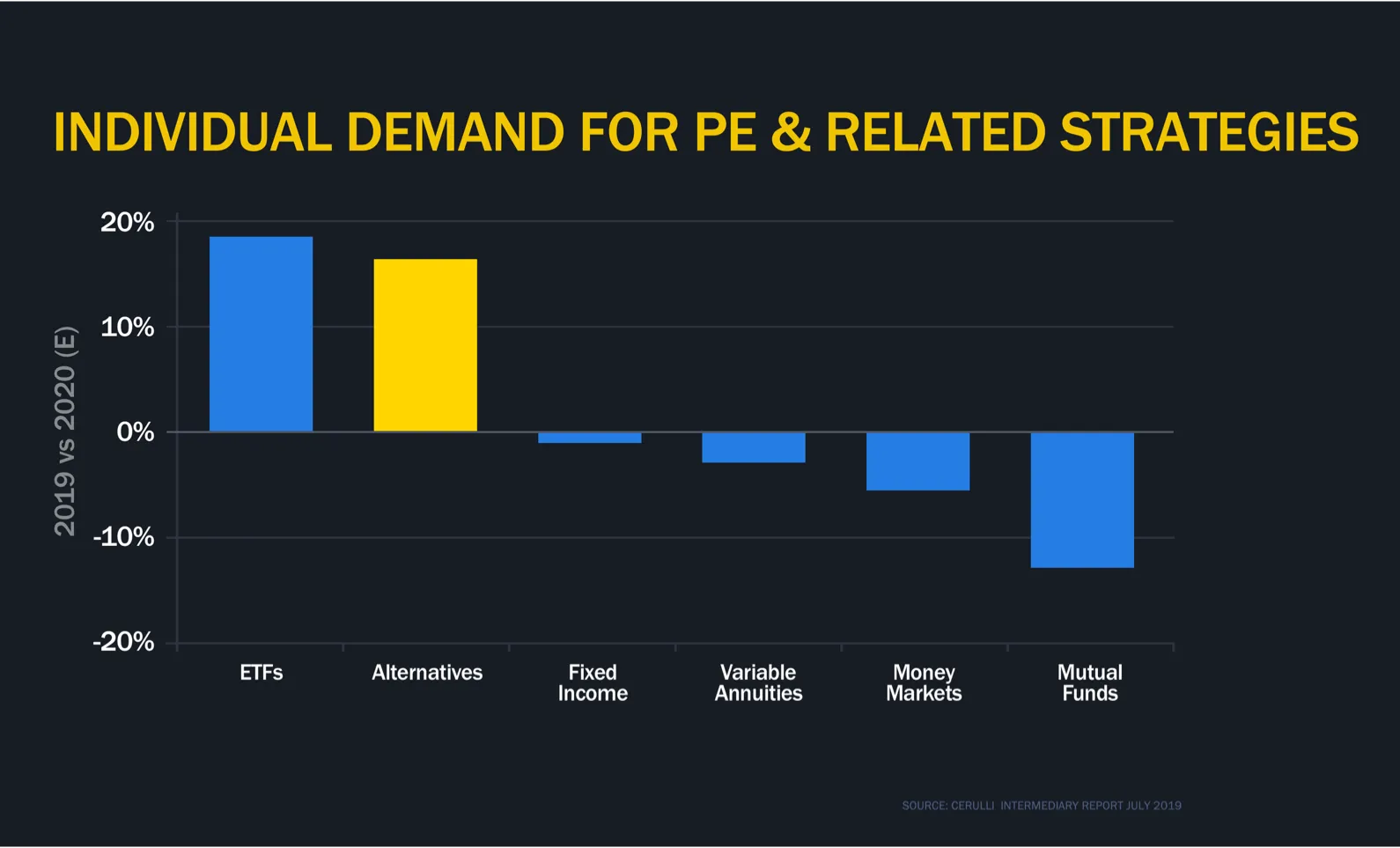

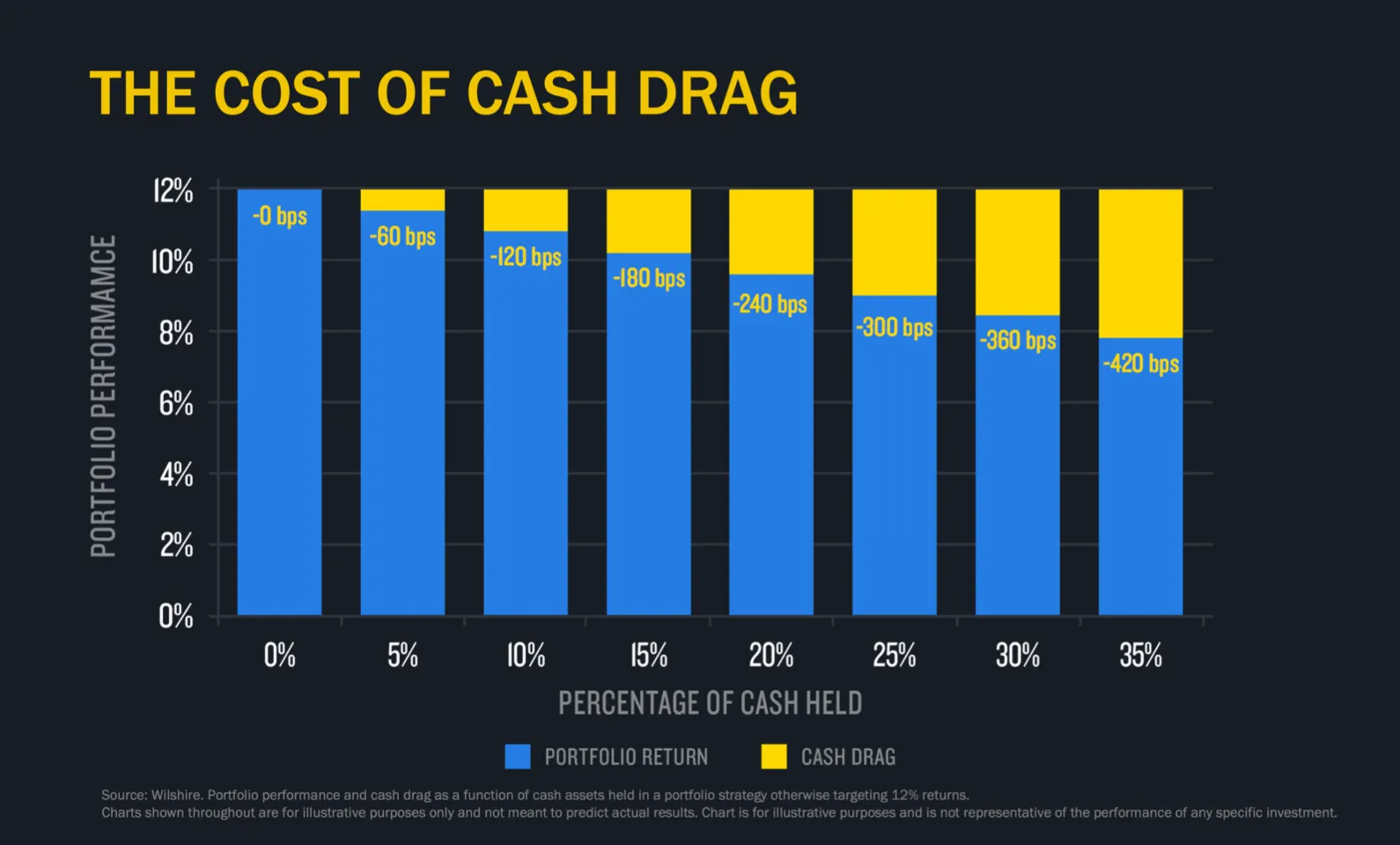

The self-paced virtual course includes six modules that cover all the basics necessary to develop a manager-specific strategy for attracting AUM from the HNW, mass affluent, and retail markets. It details the dynamics of the major individual distribution channels to these groups; explains how different product types fit those channels as well as the manager’s goals; shows how federal and state securities laws impact marketing and distribution; and highlights outsourcing and partnership opportunities that make the various approaches practical.

Why and Why Now?

Private Fund Advisors

Flows from individuals into private investment strategies are projected to approach $10 trillion over the next decade… but the window for establishing a presence in the market is limited, given the relatively few products that key intermediaries will accept onto their platforms. This course explains the practicalities of accessing this new market through various big picture strategies (like product creation vs. sub-advising roles), and how structure and feature success factors vary by distribution channel. It also explains the many outsourcing and partnering options available to address resource and capability gaps.

Private Fund Lawyers

The course explains how the realities of the financial advice industry impact the legal strategy choices private investment managers must make in pursuing the individual investor market. Those choices must account for not only the manager’s strategy and goals, but also many legally-driven, and channel-specific, business success factors. Successful lawyers in this space will be those who understand not just the latest legal wrinkles (like new liquidity features or pending State Blue Sky changes), but also the practical realities of distribution through the various individual channels (like how to match product features to the target market, or ensure compatibility with intermediary and custodial processes).

Traditional Products Executives and Lawyers

Earn Professional Credits

- This course is qualified for 7-9 CLE credit hours in multiple state Bar Associations including Florida, New York, California, and Georgia. Credit hours are estimated and are subject to each state’s approval and credit rounding rules. View complete list.

- The Stoops Center of Law & Business (at FSU College of Law) is listed in the FINRA Compliance Vendor Directory.

- The Stoops Center of Law & Business (at FSU College of Law) is applying to operate as an IAR Continuing Education Course Provider with the North American Securities Administrators Association (NASAA).

Partners and Sponsors Network

Course Modules

Executive Summary

- Market overview and key recent developments

- Market Map; matching products to channels

- Outsourcing and partnering options

Navigating the Major Channels

- RIAs – overview; reaching this rapidly growing but disparate channel

- Wirehouses and National BDs – meeting “home offices” needs, diligence processes, economics

- Regional and independent BDs – motivating brokers; product structure requirements

Using Feeder Fund Platforms

- Capabilities and Reach by channel; technology; embedded sales

- Ease of deployment; costs and timelines

- Limitations on marketability: investor eligibility, product features

Mass Affluent Vehicles, Part 1

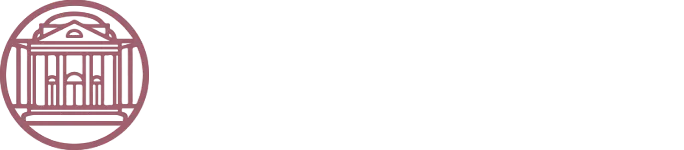

- 40 Act Funds: Requirements and Features (broad eligibility; 1099 reporting, etc.)

- Costs, timelines, operational implications (inc. affiliated party transaction prohibitions)

- Drawbacks and workarounds (leverage limitations, permissibility of incentive fees, etc.)

Mass Affluent Vehicles, Part 2

- Mass Affluent Vehicles, Part 2 BDCS and REITs: Key differences v. 40 Acts, inc. incentive fees and leverage limits

- Costs, timelines, and operational implications

- Drawbacks (inc. state blue sky registration) and workarounds

Distribution Methods

- 33 Act vs. Reg D vs. SBS; shaping products for choice of law

- FundSERV vs. AIP and other distribution and technology considerations

- New technology platforms and outsourcing options

Meet Your Instructor

Bob Rice

The Managing Partner of Tangent Capital, Bob advises major asset managers and intermediaries on the legal and business aspects of the productization of private markets strategies. He is also a frequent speaker at financial advisor and client events, giving him an appreciation for their real-world needs and wants.

Bob is a former Milbank partner and DOJ trial lawyer; was Bloomberg TV’s on-air Alternatives Editor; is the best-selling author of The Alternative Answer; and is an adjunct professor at FSU College of Law, where he teaches the Law and Business of Investment Management.

Guest Lecturers & Topics

Founder & CEO

IA Channel & RIA Database

CAIA, Managing Director

Macquarie Asset Management

SVP, Education Strategy & Programs

iCapital

Managing Partner & Co-Founder

iCapital

Democratizing Alternatives with Technology Platforms

Principal

Nasdaq

Frequently Asked Questions

Each of the six modules contains approximately 75 minutes of video recording, and learners can expect to spend an additional 2-4 hours on readings and supplemental materials, per week. While the full course is intended to last six weeks, you can view content on your schedule, with a maximum allowance of eight weeks to complete.

There are no textbooks or required course materials. However, it is recommended all learners view the extensive video library of related educational videos attached to the course made available by iCapital, which covers topics such as integration of private markets positions into individual portfolios and how financial advisors evaluate copeting “alternative” products.

This course is are ideal for lawyers in fund creation and private market departments, asset manager executives, product structuring and financial services professionals, product managers, investment and management consulting firms, and compliance and diligence teams.

Courses are offered on a pass/fail basis. Learners must score at least 75% on the final assessment to receive a Certificate of Completion for this course.

The innovative learning format of these courses allows hardworking professionals to conveniently meet, collaborate, and network with other business professionals. Discussion boards and a virtual live session with the instructor will allow for engaging conversations.

The information provided in each of this course does not, and is not intended to, constitute legal advice. The course information serves educational and informational purposes, but the Stoops Center of Law and Business and FSU College of Law expressly disclaims all liability with respect to actions taken or not taken by course participants based on any or all of the information or other content provided by this course.